Overview of Payables

| Be sure to start from the Overview top! |

|

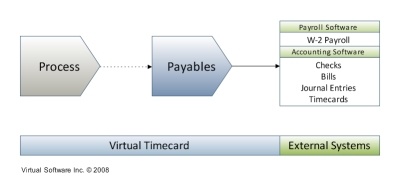

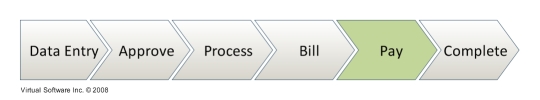

After data has been processed, the next two states in the workflow are Billables and Payables. It is from these two areas that data flows from Virtual Time+Expense into external systems. Payables relates to payments made to employees or contractors. If you do not pay for time or reimburse for expenses, this area may be unnecessary and you can either review the Billables overview or proceed to the Complete overview.

How a person is paid is based on the employment type of each user. There are four employment types in Virtual Time+Expense:

- W2 Hourly

- W2 Salary

- 1099 (hourly, one company is one contractor)

- Corp2Corp (hourly, one company can represent multiple contractors)

Based on the user's employment type, Virtual Time+Expense can create four different types of payment transactions for external systems:

- W2 Payroll

- Checks

- Bills

- Journal Entries

This flow of data is shown in figure 1 below.

|

In Virtual Time+Expense, payables are divided into three types:

- W2 Payroll (hourly and salary)

- Payables for Vendors (1099 and Corp2Corp contractors)

- Expense Payables (all types)

The first section of the Payables area is the "Payroll Details - W2". There are three options for paying hourly W2 payroll from the Payables area:

- Export W2 payroll to an external payroll system. Virtual Time+Expense calculates hourly gross payroll per employee and exports these transactions into your external payroll provider (i.e. ADP, Paychex).

- Export Timecards to accounting software. Virtual Time+Expense exports timecards to the time tracking module in your accounting software. Note that you do not change the way that payroll is processed or how you use your accounting software - the manual process of entering time information is done for you.

- Export Journal Entry to accounting software. Virtual Time+Expense exports a journal entry based on the information that appears in this section to your accounting software (Can be used in conjunction with both 1 & 2).

The next section of the Payables area is "Payroll Details - Payables". There are three options for paying contractor (1099 / Corp2Corp) payments from the Payables area:

- Export Bills. Virtual Time+Expense calculates the payment to the Vendor, whether a 1099 or Corp2Corp, and exports these transactions to your accounting software as a bill.

- Export Checks. Virtual Time+Expense calculates the payment to the Vendor, whether a 1099 or Corp2Corp, and exports these transactions to your accounting software as a check.

- Export 1099 as W2. Virtual Time+Expense groups 1099 payable information and pays contractors in the same way as W2 employees. Note in this case that 1099's are then moved to the "Payroll Details - W2" section and Corp2Corp remain in the "Payroll Details - Payable". This is usually used to pay contractors with direct deposit.

The last section of the Payables area is "Payable Expense Details". There are four options for paying Expense Reports from the Payables area:

- Export Checks. Virtual Time+Expense tracks reimbursable expenses paid to W2 employee per expense report and exports the these transactions to your accounting software as a check. Note, if option 2 from "Payroll Details - Payables" is selected, 1099's will be paid with checks.

- Export Bills. Virtual Time+Expense tracks reimbursable expenses paid to 1099 / Corp2Corp per expense report and exports these transactions to your accounting software as a bill.

- Export Credit Card Charges. Virtual Time+Expense records charges made on a company credit card and exports these transactions to your accounting software as a credit card charge linked to the corresponding credit card account.

- Export Journal Entries. For non-reimbursable expenses, Virtual Time+Expense tracks those that are billable to a customer and exports these transactions to your accounting software as a journal entry. This is also applicable to expenses that are reimbursed through a payroll service or in another fashion independent of your accounting software.

Up until this point, timecards were viewed as timecards and expense reports were viewed as expense reports. The Payables area presents information in terms of what it will be exported as - payments. As you process data, it arrives in the Payables area, and is converted and added to the other information waiting to be exported.

TBD Sample topics to cover:

- VT has the ability to generate gross W2 payroll and export it to a 3rd party payroll system. If you use a payroll system that does payroll from timecards (QuickBooks), you can export just the timecards from here.

- VT has the ability to generate payments to subcontractors as bills to your accounting software

- VT has the ability to generate reimbursements for expenses (checks for employees, bills for contractors)

- Fork in the road equal to Billables

- One of 2 areas (w/ billables) where you interface with accounting software

- Export timecards - from either billables or payables not both

- Can set "no payables" per project to turn off payments, shows up as "zero" balanced payment

- VT deals with hourly payroll, setting someone to "salaried" zero's out the payments (do normal salaried payroll within your payroll system)

- You can set a global pay cycle (groups data) or set it per user, pay is grouped by cycle which makes it easy to deal with the one cycle (i.e. exporting weekly payments at the end of the week, monthly at the end of the month). Tools to select by cycle or within each cycle

Build up concept / to do - as you process time within each pay cycle, the time is added to pending payments. Export them when you have all the data you need to do your payroll.

Each time you export a grouping (or all) of your payables, a unique id is assigned to that export. You can always see (or re-export) previous exports and they will always retain that grouping (payments that are exported together stay together).

| Next steps: |

Workflow

Complete! Workflow

Complete!

|

Overview

of Billables Overview

of Billables

|

Details for the

Payables area Details for the

Payables area

|